What we Offer?

Comprehensive Digital KYC services designed for speed, compliance, and trust.

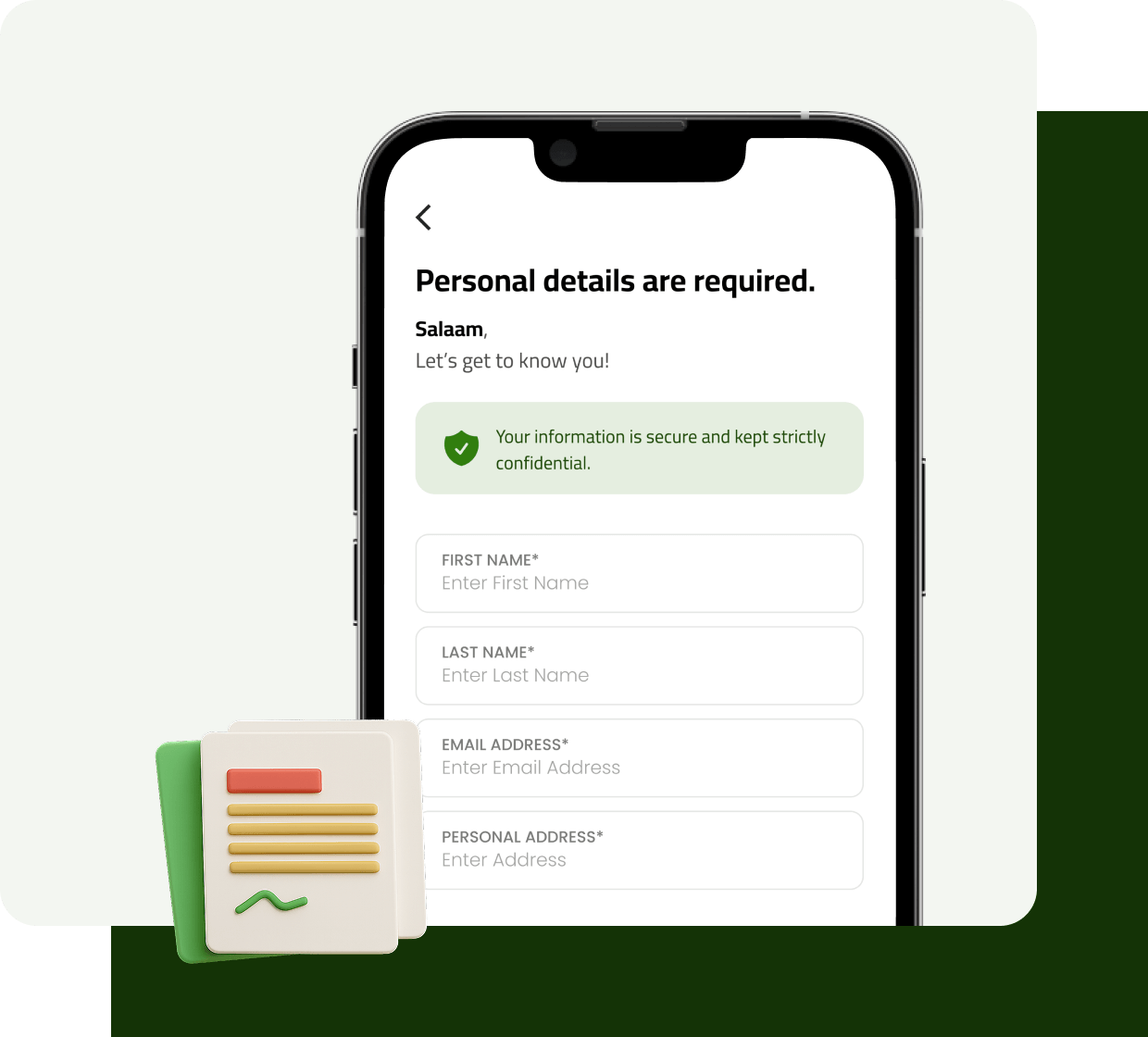

Digital KYC Services

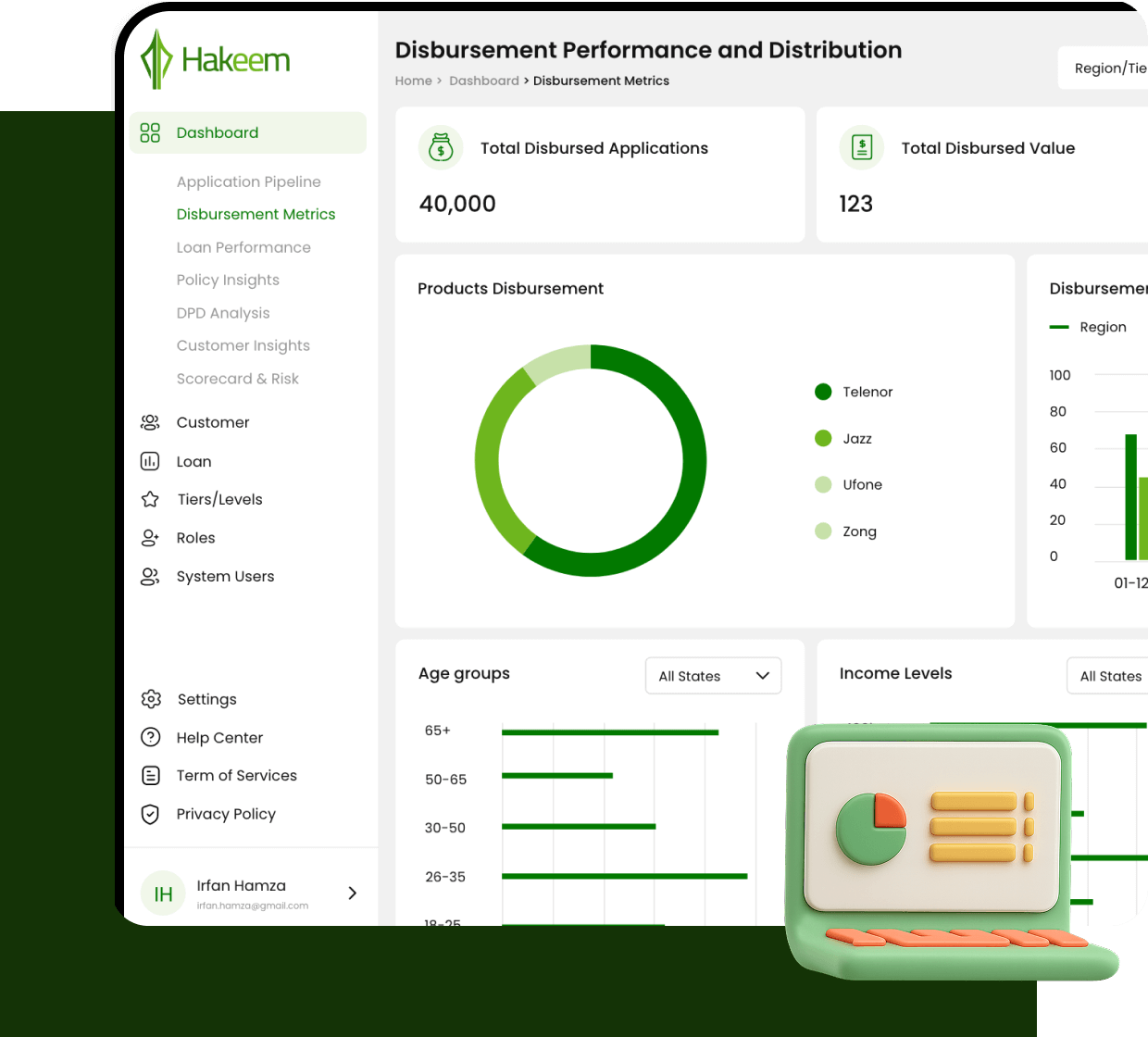

Loan Management System

Credit Scoring Service

Digital Lending Engine

Why Hakeem?

Islamic by Design

Built from the ground up, our stack embeds Shariah compliance in every layer Fatwa-backed, audit-ready, and aligned with Islamic principles throughout.

Easily Integratable

Launch quickly with plug-and-play APIs, SDKs, and white-labeled frontends. Our modular stack lets banks, NGOs, telcos, and fintechs integrate only what they need.

Tailored for the Underserved

Built for thin-file users and low-income communities, our system offers inclusive, localized experiences with e-KYC, mobile-first UX, and multilingual support.

Real-Time Reporting & Insights

Our dashboards provide real-time tracking, Shariah audit trails, and portfolio insights — ensuring compliance and performance in one unified view.

Proven in the Field

Proven and scalable our platform powers Hakeem, serving 500,000+ users with PKR 430M disbursed across 70+ cities, showcasing real-world impact from urban centers to remote villages.

Bring the power of Hakeem’s proven platform to your organization.

Let’s partner to expand financial dignity across communities.