Digital & Accessible

Paperless, fully digital finance that reaches both cities and villages. No paperwork, no branches, just simple access wherever you are.

Ethical & Inclusive

Shariah-compliant, riba-free solutions designed for everyone, from women entrepreneurs to gig workers to daily-wage earners, everyone and anyone who qualifies.

Smart & Secure

AI-powered credit evaluation ensures fairness, while secure, transparent systems build trust at every step.

Everyday Needs, Real Solutions

Meeting Your Needs with Precision, Innovative Shariah Based Approach to Simplify Life's Complexities.

Pay utility bills

Buy a sewing machine for a home business

Fix your phone

Pay Rent

Pay School Fees

Cover Health Expenses

Restock Your Shop or Stall

Repair Your Rickshaw or Bike

Buy Exam Prep Books

Buy Kitchen Supplies For a Home Food Business

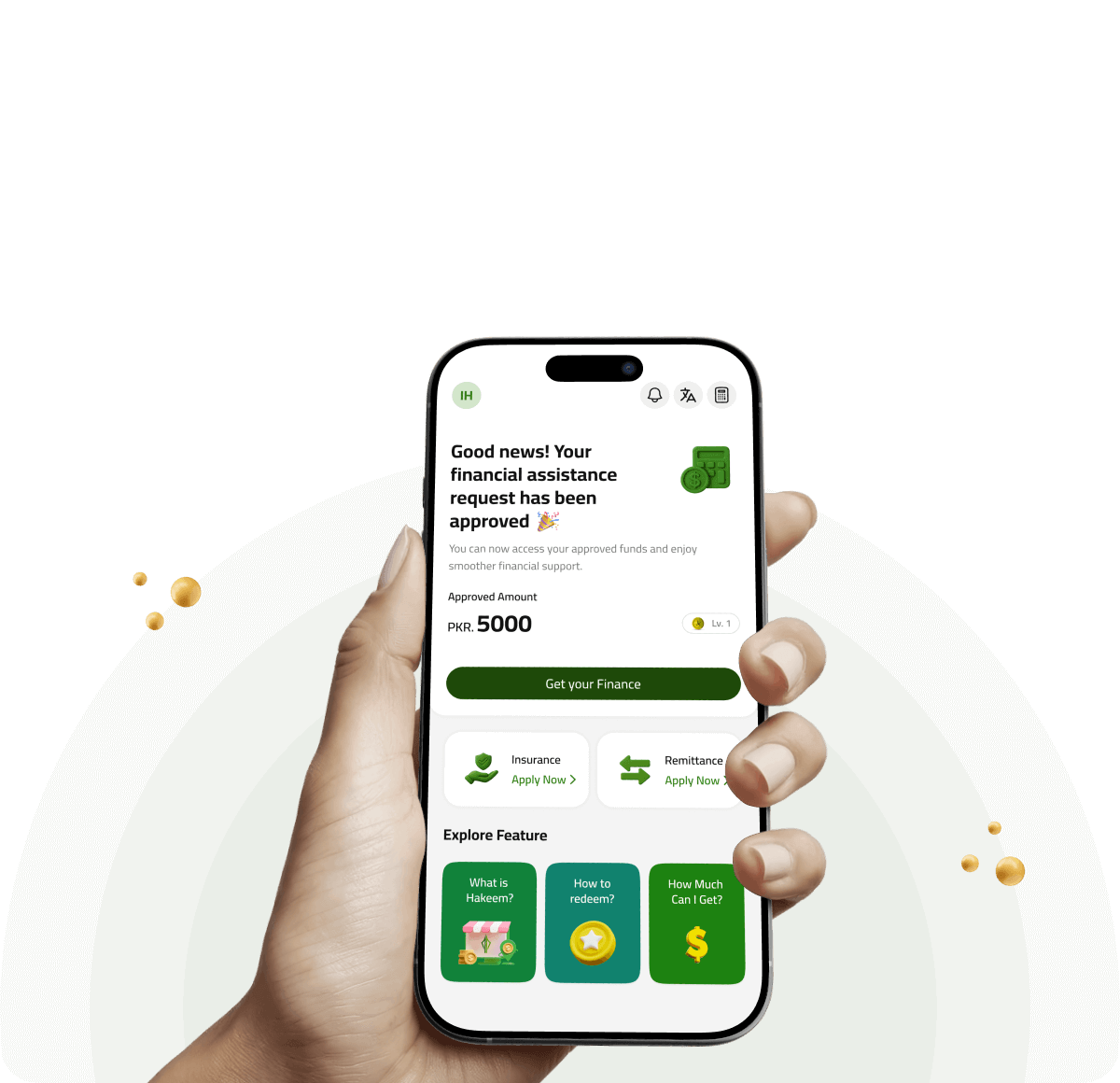

How Hakeem Works

Unlock instant funds effortlessly by following these streamlined steps:

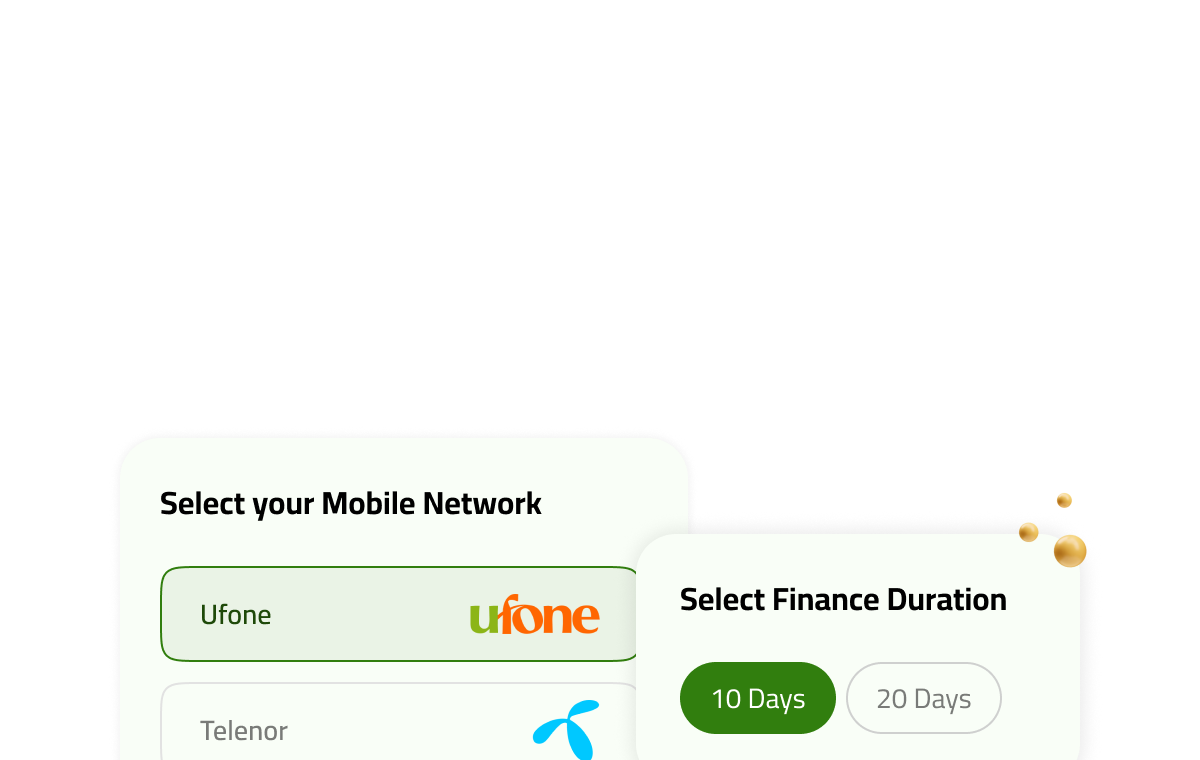

Get Airtime

Purchase airtime from Hakeem at a deferred price.

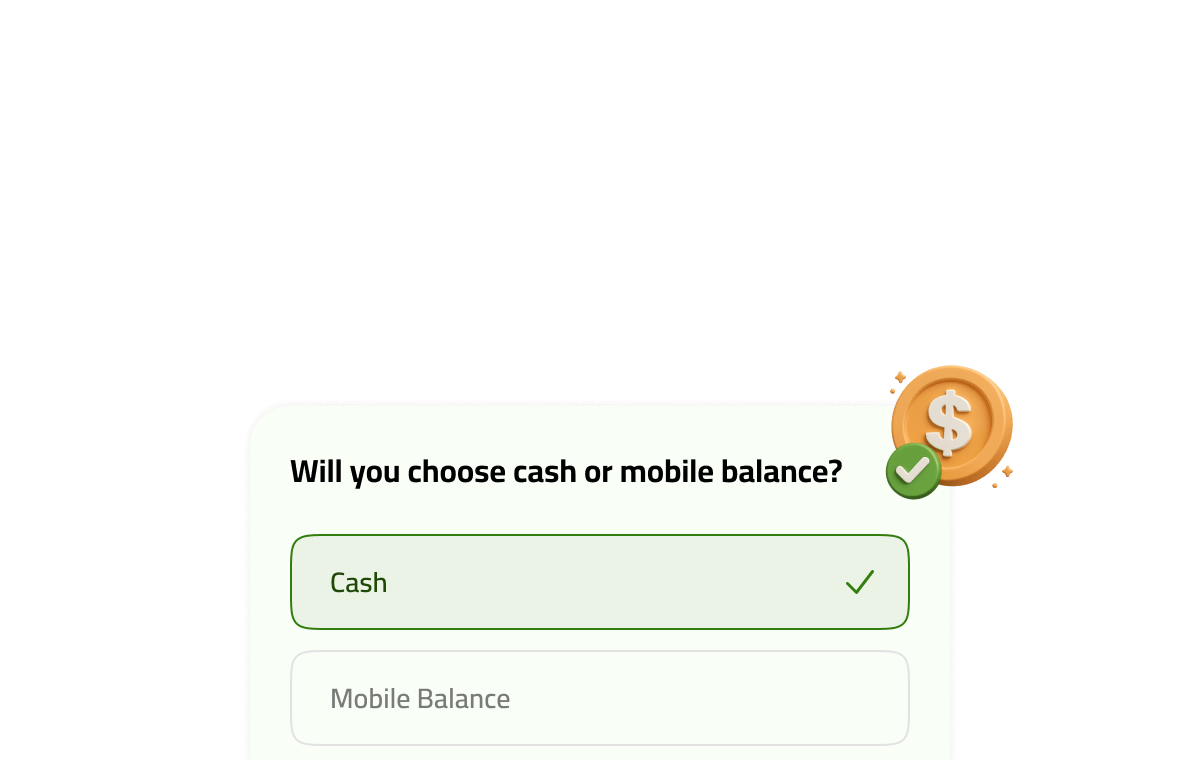

Get Cash

If you choose to sell, the buyer pays the market price for the airtime, and the proceeds are credited to your account.

Choose What to Do With It

Sell it as a commodity to an approved buyer within the app.

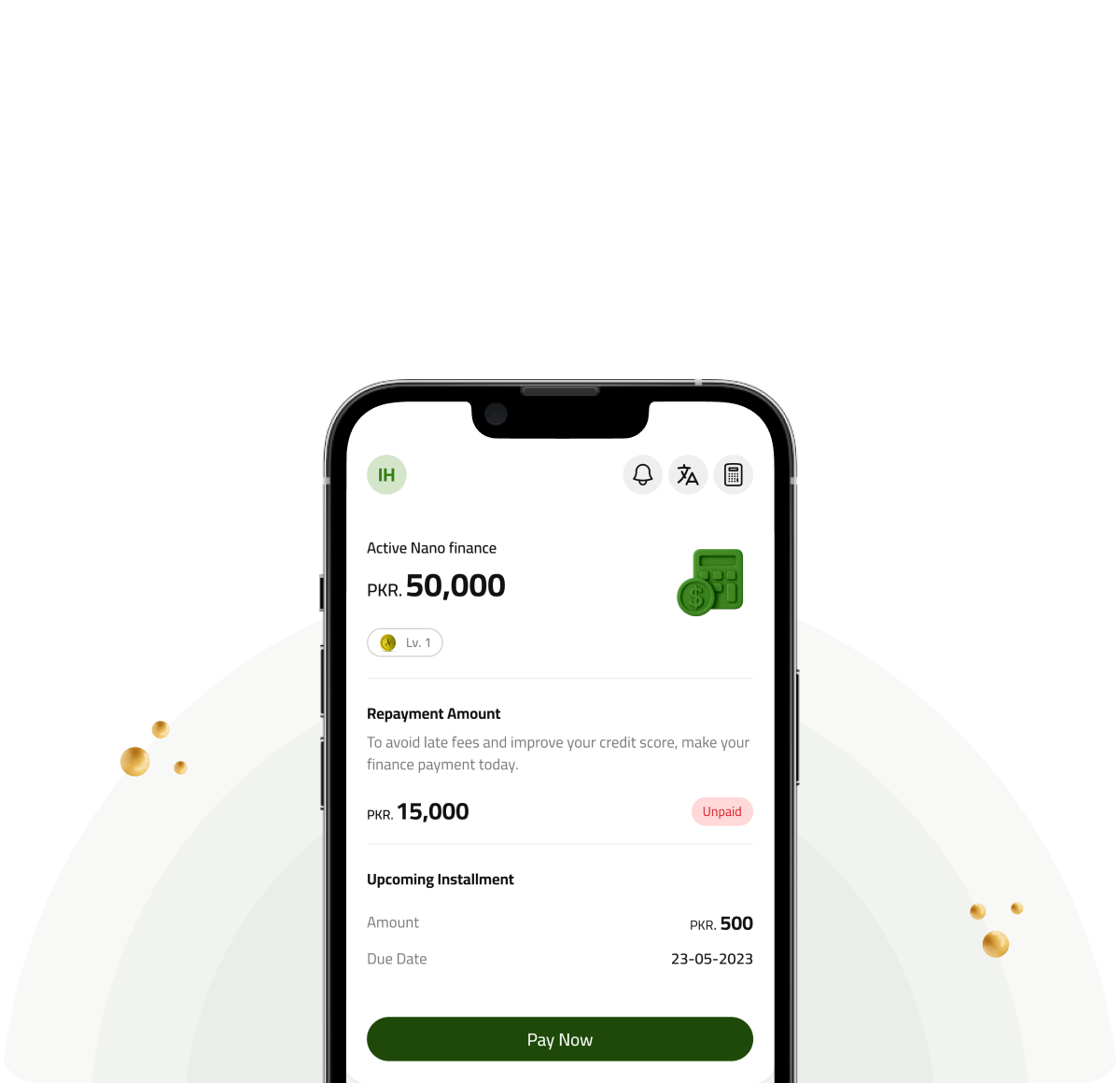

Repay Over Time

You repay the amount in easy instalments, with a pre-agreed profit, in full compliance with Islamic finance principle.

Know Before You Apply

Use our Shariah-compliant calculator to instantly explore your repayment amount with full transparency and no hidden surprises.